Key Highlights

- A tender issued by CIDCO for a 10-acre plot (approx. 42,000 m²) in Kharghar’s Sector 23 attracted a record bid of ₹2,120 crore.

- The bid translates to roughly ₹5 lakh per m² (≈ ₹5,000 per ft²) for the land parcel.

- The winning bidder: Aakar Developers, who must pay 50% of the bid amount to CIDCO within the next 3 months.

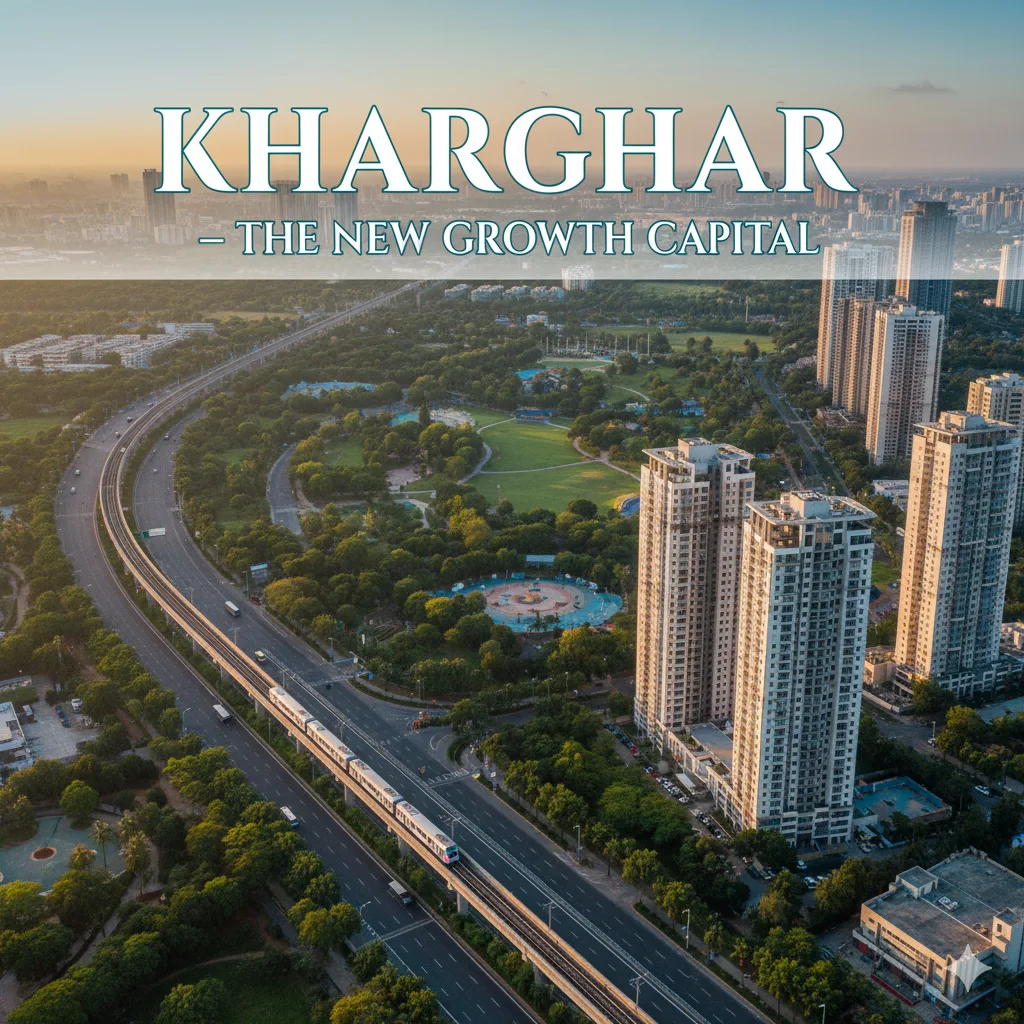

- Market commentary highlights that Kharghar’s attractiveness is driven by major infrastructure. Upcoming developments like the Navi Mumbai International Airport, international educational institutions and a golf course.

- Developers mention extra FSI (floor space index) available in the zone but also warn of the project-completion timeline (4-year deadline) and possible penalties for delays.Propda.com

Why This Tender Matters for Real Estate in Navi Mumbai

This record bid signals a major shift in the real-estate dynamics of Navi Mumbai, particularly in Kharghar and its surrounding nodes. Here’s how:

- Land Price Benchmark Up – The ₹2,120 crore price sets a new benchmark for large-plots in Navi Mumbai’s premium nodes. This uplifts land value across neighbouring developments.

- Accelerated Infrastructure Confidence – The strong bid reflects investor confidence in long-term infrastructure like the airport, metro corridors and planned township clusters.

- Upshift in Residential & Commercial Projects – With higher land cost, developers may bring premium product offerings (luxury homes, mixed-use developments) to justify returns.

- Supply & Pricing Impact for Buyers – End-buyers may see moderate price increases in nearby projects as developers pass on higher land costs; early movers may benefit more.

- Investment Signal – For investors, this is a cue that Kharghar (and similar nodes) are entering a more premium phase of growth, suggesting strong appreciation potential.

What This Means for Homebuyers & Investors

- If you’re looking at new launches in Kharghar, expect rates to reflect the new land-price reality — but also anticipate value from location advantage.

- For mid-income buyers, consider nearby nodes that may still offer more affordable rates while benefiting from Kharghar’s uplift.

- For commercial or mixed-use investments, the higher land cost may push turnkey projects with amenities, premium finishes, and longer-term appreciation.

- Due diligence becomes even more important: check RERA status, builder track-record, timeline commitments (especially given 4-year completion norms) and extra amenities tied to higher FSI. Propda.com

Tips to Make Smart Decisions in This Scenario

- Compare older vs new launches: Older launches pre-benchmark may offer better value. Newer ones may command premium pricing but also newer features.

- Check connectivity & upcoming infrastructure: Infrastructure that justifies premium pricing includes the airport, metro links, new commercial zones.

- Evaluate developer credibility & timeline: With higher cost incurred by developers, delays may impact returns — ensure deadlines are realistic.

- Look for features that add value: Larger-scale amenities, branded offices, international schools, green zones — these help justify premium pricing.

- Think mid-to-long-term: In premium nodes undergoing uplift, 5-10 year investment horizon often yields stronger gains. Propda.com

Conclusion

The ₹2,120 crore bid by Aakar Developers for the 10-acre plot in Kharghar’s Sector 23 is a clear indicator: Kharghar is transitioning into a higher-tier real-estate zone in Navi Mumbai. For both homebuyers and investors, this is a moment to evaluate — whether to move in early into high-growth potential, or diversify into nearby nodes still enjoying value advantage. https://propda.com/